El COHEP Publica Boletín Competitivo Regional Abril 2023

31 March 2022

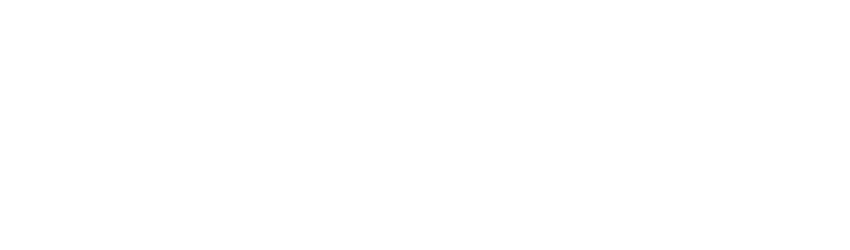

PERSPECTIVAS DE CRECIMIENTO ECONÓMICO 2023

Los índices de crecimiento económico podrían estar condicionados, además de las variables internacionales, por los niveles de inversión que sean capaces de captar los países centroamericanos en medio de un panorama que apuntó al aumento de los costos financieros, confianza empresarial en declive y fuerte incertidumbre normativa.

Las perspectivas de crecimiento económico del Istmo centroamericano se atenuarán al pasar de 4.7% en 2022 a 2.9% en 2023 en la medida se desaceleré la economía de los Estados Unidos de América, se reduzcan los niveles de exportación, se incremente el endurecimiento de las condiciones financieras mundiales y persistan las tensiones geopolíticas. Incluso, se espera que estas tenues señales de crecimiento económico se puedan agudizar en la medida que las presiones inflacionarias persistan y se incrementen las turbulencias financieras.

RIESGOS PARA EL 2023

De acuerdo con el Centro de Estudios Internacionales (CEIUC), algunos de los riesgos que limitarían los niveles de crecimiento y desarrollo económico de la región son:

- CRIMEN ORGANIZADO: el crimen organizado crecedonde el Estado es relativamente débil, las instituciones

corruptas y predominan las economías informales con altas tasas de desigualdad y pobreza.

- GOBERNABILIDAD COMPLEJA: debido a las altas expectativas ciudadanas sobre los nuevos gobiernos, la fragmentación política, la falta de acuerdos y el alto endeudamiento público.

- NUEVOS ESTALLIDOS DE MALESTAR SOCIAL: causados por el alto costo de vida, bajo crecimiento económico, aumento del desempleo e informalidad y un menor espacio fiscal.

- PÉRDIDA DE COMPETITIVIDAD: debido al bajo desarrollo de los recursos naturales y de las energías limpias, la falta de acciones concretas en materia de atracción de inversión y por la falta de certeza jurídica en países de la región.

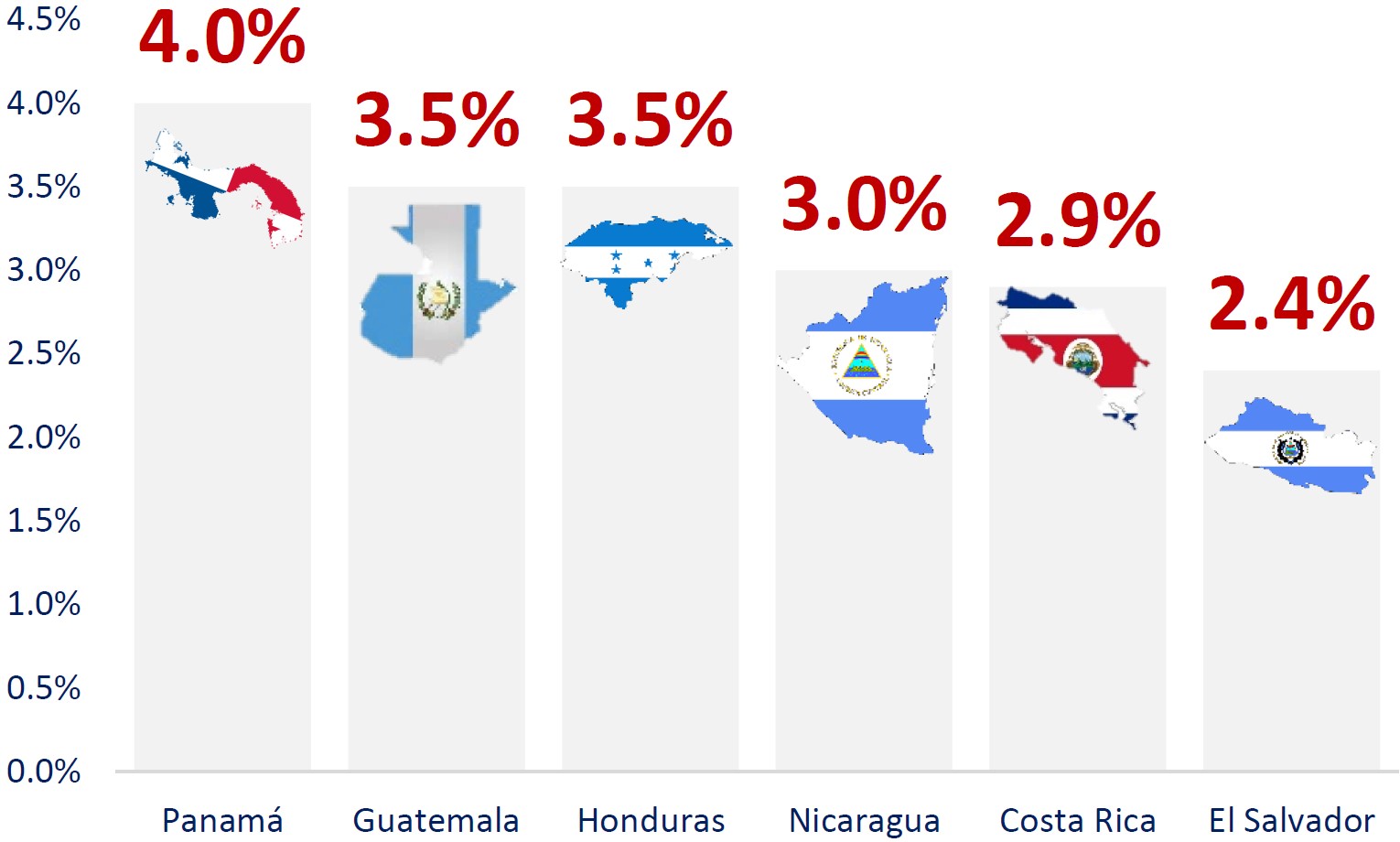

RIESGO PAÍS (EMBI)

Mantener un riesgo país bajo es importante debido a que da más certeza del clima de negocios de un país y facilita la atracción de inversión extranjera. A su vez mantener un riesgo país bajo demuestra el estado de la certidumbre de una nación a corto y mediano plazo.

Mientras menor certeza de que el país honrará sus obligaciones, más alto será el EMBI de dicha nación, y viceversa.

Mientras menor certeza de que el país honrará sus obligaciones, más alto será el EMBI de dicha nación, y viceversa.

Países como Panamá, Guatemala mantuvieron un EMBI por debajo de 3.00% y Costa Rica denota un EMBI promedio de 3.27%.

Honduras (5.66%) mostró un EMBI mayor que el promedio latino, mientras que El Salvador sigue denotando un alto EMBI al estar por encima del 15%.

En comparación con los promedios de marzo del 2022, los puntajes de riesgo de los países de la región se han reducido con excepción de Panamá que pasó de 2.22 en marzo 2022 a 2.34 en marzo 2023

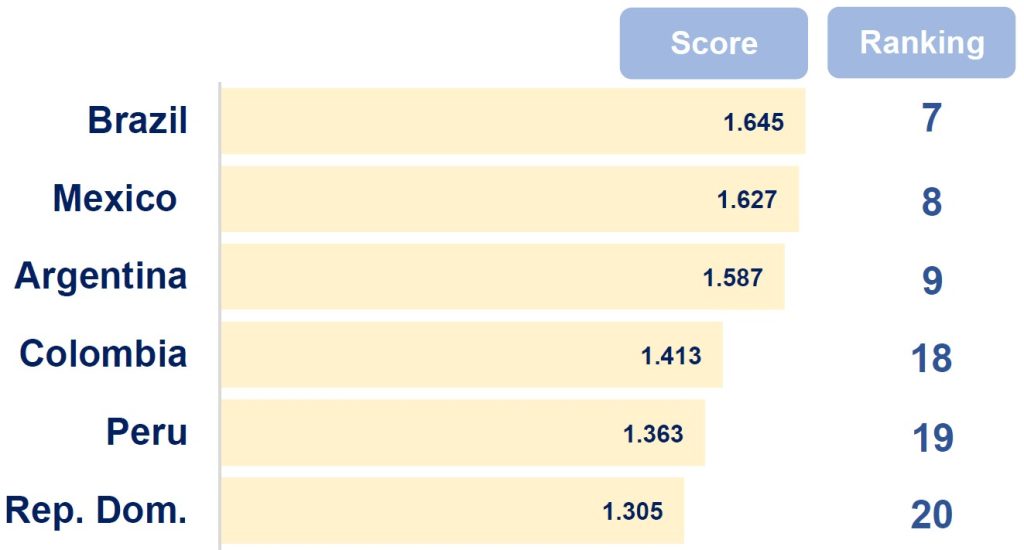

ÍNDICE DE CONFIANZA DE INVERSIÓN EXTRANJERA DIRECTA

El Índice de Confianza de la Inversión Extranjera Directa (IED) elaborado por The Kearney Advisor Network establece un ranking de economías que son más atractivas para la IED en el presente y en los próximos tres años.

En el ranking de economías desarrolladas destacan: Estados Unidos, Canadá y Japón en los primeros puestos. Para el ranking de economías en desarrollo, Brasil, México y Argentina están entre el top 10 como destino más atractivo para la captación de inversión extranjera.

De acuerdo con el Índice, los inversores prevén un incremento en el precio de commodities y un aumento en las tensiones geopolíticas para el año en curso. Los inversionistas buscan priorizar y llevar su capital en mercados con regulaciones gubernamentales transparentes, con bajos niveles de corrupción y con buenas capacidades tecnológicas.

Entre los factores que influyen para invertir en economías en vías de desarrollo, destacan la buena calidad de infraestructura, estabilidad politica, capacidad tecnológica, así como las tasas impositivas.

Países de la región de América Latina evaluados en este Ranking:

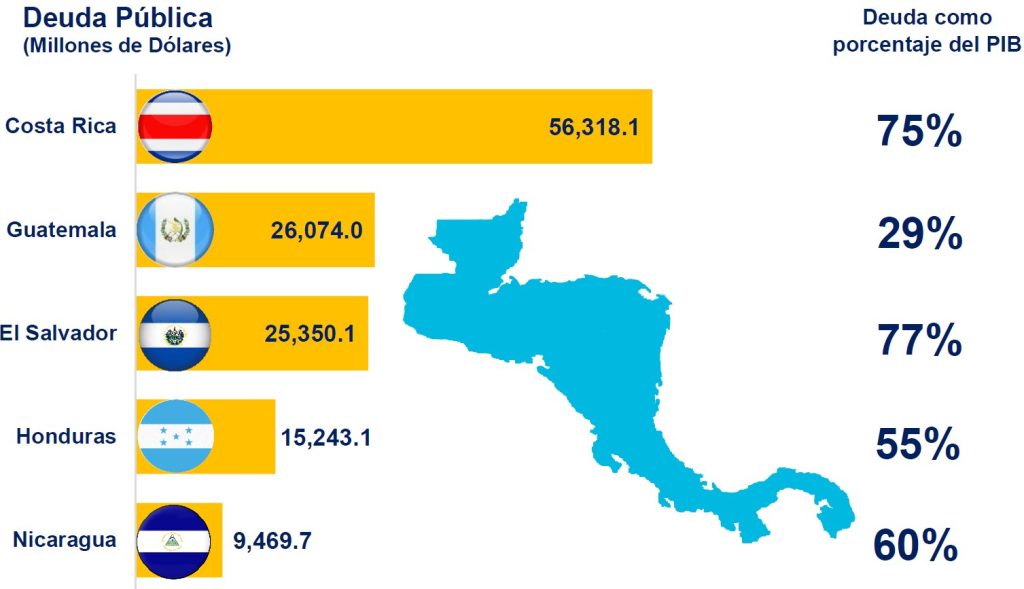

DEUDA PÚBLICA

En promedio entre 2020 y 2021, la deuda pública de los países de la región aumentó un 9%, no obstante Honduras y Nicaragua registraron los incrementos más elevados, por encima del promedio, 13% y 12% respectivamente.

Para el 2022 esta tendencia se mantuvo, aunque con mucha menor fuerza dado que el aumento promedio de la deuda pública fue del 2% al cierre del tercer trimestre, lo cual responde principalmente a la necesidad de cubrir el déficit fiscal, sobre todo para el caso de Honduras, que planificó un gasto cerca a los 16 mil millones de dólares y aumentar el déficit al 6.3 % del PIB.

Para el 2023, es posible que la deuda pública, en promedio, en Centroamérica, se ubique en un 50% del PIB de la región, siendo Costa Rica y El Salvador los países que se ubicarían muy por encima de este promedio, cercano al 70% del PIB y Guatemala en el extremo opuesto con una relación Deuda/PIB menor al 35%, según ICEFI.

Fuente: Elaborado por la GPE/COHEP con datos de la Secretaría del Consejo Monetario Centroamericano (SECMCA), BCH y SEFIN, ICEFI

Nota: Los datos se encuentran actualizados a octubre 2022, solamente Honduras muestra datos a septiembre.

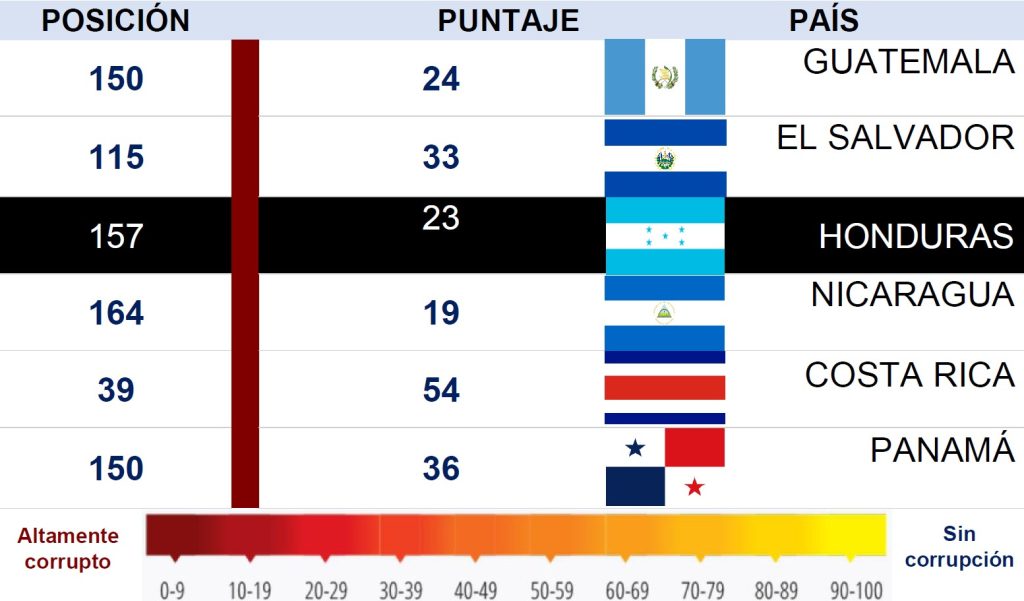

ÍNDICE DE PERCEPCIÓN DE LA CORRUPCIÓN 2021

El Índice de Percepción de la Corrupción es el ranking sobre corrupción más utilizado en el mundo y tiene como objetivo calificar los niveles percibidos de corrupción en el sector público de cada país de acuerdo con fuentes de información y opiniones de expertos.

La región centroamericana se ubica dentro del 30% de países con la mayor percepción de corrupción con excepción de Costa Rica que posee una puntuación de 54/100 ubicándolo dentro del 20% de países evaluado por Transparencia Internacional.

En cambio, Nicaragua fue el país con mayor percepción de la corrupción en la región con una puntuación de 19 ubicándolo dentro del 10% de países con mayor percepción de la corrupción, seguido por Honduras con una puntuación de 23 lo ubican dentro de 25% de países con la mayor percepción de corrupción.

Fuente: Elaborado por GPE/COHEP con datos de Transparencia Internacional

Nota: El Ranking evalúa 180 países y las puntuaciones van de 0 a 100, indicando que entre más se acerque a 100, mejor posicionado esta un país.